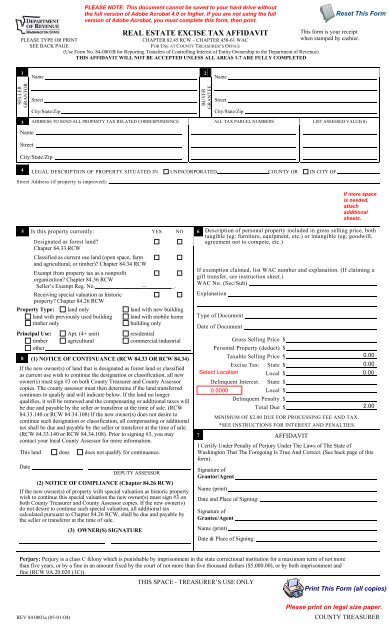

PLEASE TYPE OR PRINT SEE BACK PAGE REAL ESTATE EXCISE TAX AFFIDAVIT CHAPTER 82.45 RCW – CHAPTER 458-61 WAC FOR USE AT COUNTY TREASURER’S OFFICE (Use Form No. 84-0001B for Reporting Transfers of Controlling Interest of Entity Ownership to the Department of Revenue) THIS AFFIDAVIT WILL NOT BE ACCEPTED UNLESS ALL AREAS 1-7 ARE FULLY COMPLETED This form is your receipt when stamped by cashier. 1 2 Name Name SELLER GRANTOR Street City/State/Zip BUYER GRANTEE Street City/State/Zip 3 ADDRESS TO SEND ALL PROPERTY TAX RELATED CORRESPONDENCE ALL TAX PARCEL NUMBERS LIST ASSESSED VALUE(S) Name Street City/State/Zip 4 LEGAL DESCRIPTION OF PROPERTY SITUATED IN UNINCORPORATED COUNTY OR IN CITY OF Street Address (if property is improved): 5 Is this property currently: YES NO 6 Description of personal property included in gross selling price, both tangible (eg; furniture, equipment, etc.) or intangible (eg; goodwill, Designated as forest land? agreement not to compete, etc.) Chapter 84.33 RCW Classified as current use land (open space, farm and agricultural, or timber)? Chapter 84.34 RCW Exempt from property tax as a nonprofit organization? Chapter 84.36 RCW Seller’s Exempt Reg. No. — . Receiving special valuation as historic property? Chapter 84.26 RCW Property Type: land only land with new building land with previously used building land with mobile home timber only building only Principal Use: Apt. (4+ unit) residential timber agricultural commercial/industrial other 8 (1) NOTICE OF CONTINUANCE (RCW 84.33 OR RCW 84.34) If the new owner(s) of land that is designated as forest land or classified as current use wish to continue the designation or classification, all new owner(s) must sign #3 on both County Treasurer and County Assessor copies. The county assessor must then determine if the land transferred continues to qualify and will indicate below. If the land no longer qualifies, it will be removed and the compensating or additional taxes will be due and payable by the seller or transferor at the time of sale. (RCW 84.33.140 or RCW 84.34.108) If the new owner(s) does not desire to continue such designation or classification, all compensating or additional tax shall be due and payable by the seller or transferor at the time of sale. (RCW 84.33.140 or RCW 84.34.108). Prior to signing #3, you may contact your local County Assessor for more information. This land does does not qualify for continuance. Date DEPUTY ASSESSOR (2) NOTICE OF COMPLIANCE (Chapter 84.26 RCW) If the new owner(s) of property with special valuation as historic property wish to continue this special valuation the new owner(s) must sign #3 on both County Treasurer and County Assessor copies. If the new owner(s) do not desire to continue such special valuation, all additional tax calculated pursuant to Chapter 84.26 RCW, shall be due and payable by the seller or transferor at the time of sale. (3) OWNER(S) SIGNATURE If exemption claimed, list WAC number and explanation. (If claiming a gift transfer, see instruction sheet.) WAC No. (Sec/Sub) Explanation Type of Document Date of Document Gross Selling Price $ Personal Property (deduct) $ Taxable Selling Price $ Excise Tax: State $ Local $ Delinquent Interest: State $ Local $ Delinquent Penalty $ Total Due $ MINIMUM OF $2.00 DUE FOR PROCESSING FEE AND TAX. *SEE INSTRUCTIONS FOR INTEREST AND PENALTIES 7 AFFIDAVIT I Certify Under Penalty of Perjury Under The Laws of The State of Washington That The Foregoing Is True And Correct. (See back page of this form). Signature of Grantor/Agent Name (print) Date and Place of Signing: Signature of Grantee/Agent Name (print) Date & Place of Signing: Perjury: Perjury is a class C felony which is punishable by imprisonment in the state correctional institution for a maximum term of not more than five years, or by a fine in an amount fixed by the court of not more than five thousand dollars ($5,000.00), or by both imprisonment and fine (RCW 9A.20.020 (1C)). THIS SPACE - TREASURER’S USE ONLY REV 84 0001a (05-01-04) COUNTY TREASURER

By publishing your document, the content will be optimally indexed by Google via AI and sorted into the right category for over 500 million ePaper readers on YUMPU.

This will ensure high visibility and many readers!

PUBLISH DOCUMENT No, I renounce more range.

You can find your publication here:

Share your interactive ePaper on all platforms and on your website with our embed function