A version of this article was published in the December 2022 edition of California CPA Magazine.

While 2022 has presented a shift toward pre-pandemic habits and expectations for some people, there continues to be pressing issues and questions for tax professionals across California. Some topics have continued to evolve, while others are seeing their first appreciable development in several years.

In the following, you’ll find more details on income tax perspectives, income tax credits, disaster loss deductions, and an item discussing an important development related to unclaimed property enforcement.

There are updates or updated guidance for some tax rules, including the elective pass-through entity tax, suspension or limitation of certain attributes, and nexus considerations.

California enacted an elective pass-through entity (PTE) tax regime in 2021. The election is administered by the Franchise Tax Board (FTB) and can be an avenue for qualifying taxpayers to mitigate the tax impact of the federal $10,000 cap on the deductibility of taxes imposed at the state and local level by shifting the incidence of tax off individual partners or shareholders and onto the PTEs themselves.

On February 9, 2022, Governor Gavin Newsom signed CA Senate Bill 113 (SB 113), which expanded the definition of a qualified taxpayer in Section 17052.10(b)(3)(b) of the California Revenue and Taxation Code to also include:

The legislation also adopted the following modifications to the PTE tax, which may be favorable to certain taxpayers:

Keep an eye on the FTB site for more information and updates.

Assembly Bill 85 (AB 85), which was signed into law in 2020, suspended the utilization of NOLs—for both corporate and individual taxpayers with taxable income of more than $1 million—for tax years beginning January 1, 2020, and ending on or before December 31, 2022. SB 113 decreased that suspension period by one year, making the suspension applicable for tax years beginning on or after January 1, 2020, and before January 1, 2022.

The state’s general 20-year NOL carryforward may be extended by taxpayers impacted by the NOL suspension for up to three years if the losses can’t be used due to the NOL suspension.

One potential ramification of NOL deductions is the possibility of owing alternative minimum tax (AMT) due to an existing limitation on using NOLs when computing AMT.

SB 113 also removed the former limitation on the use of business tax credits to offset a maximum of $5 million of tax for tax year 2022. AB 85 had originally placed said limit on the use of business tax credits for tax years 2020–2022.

For California income tax purposes, doing business is defined as actively engaging in any transaction for the purpose of financial or pecuniary gain or profit.

For the taxable year beginning on or after January 1, 2021, a taxpayer is seen as doing business in California for a taxable year if any of the following conditions are satisfied:

The doing business thresholds for taxpayers are indexed for inflation and revised annually.

Federal PL 86-272 protects businesses from state taxes based on net income where the business’s contact with a state doesn’t exceed the solicitation of sale of tangible goods.

As such, if a potential taxpayer’s only physical connection with a state is the delivery of goods to in-state customers, they would be protected against income taxes. This, however, doesn’t extend to gross receipts, franchise, or net worth taxes.

In 2021, the Multistate Tax Commission (MTC) adopted revised guidance to its interpretation of the application of PL 86-272 related to the online and digital economy. In February 2022, California issued a Technical Advice Memorandum (TAM) aligned with the MTC’s guidance.

MTC guidance states that a business whose customer is using the business’s website in the customer’s home state is an activity of the business in the customer’s state. The guidance then describes the protections of PL 86-272 in this context.

The MTC’s guidance concludes that most activities performed remotely over the internet, such as interactive chat and email features, could exceed the protections of PL 86-272, which could vitiate the business’s protection under it, unless those activities directly serve a sales purpose such as the solicitation of an order of tangible personal property (TPP). So, the MTC’s guidance significantly limits the application of PL 86-272.

By adopting this guidance, California mandated that both in-state and out-of-state businesses analyze their website and online activities when assessing whether they’re subject to tax.

The FTB hasn’t provided a comprehensive list of activities that exceed the protections of PL 86-272. It has, however, advised that the following activities exceed those protections:

Websites used by California customers generally don’t exceed the protections of PL 86-272 if they don’t offer non-TPP and the business doesn’t engage in any other California business activities. Websites also may not exceed the protections provided by PL 86-272 if only used to:

Cookies on a customer’s computer don’t disqualify a business from protections if they’re only used in California by that business to:

Notably, California’s TAM states that merely posting static FAQs on the business website, even if California customers access that information, stays within the law’s protections.

The TAM applies the same standards to outbound and inbound transactions and speaks broadly in terms of destination state and origin state, rather than limiting itself to California specifically. This suggests California’s guidance on the applicability of PL 86-272 could be beneficial for certain businesses and detrimental to others.

For example, by removing the protections provided by PL 86-272 on goods shipped from California, a corporate taxpayer could reduce its California apportionment factor by reducing its California-sourced throwback receipts. Alternatively, by removing the protections provided by PL 86-272, an out-of-state taxpayer could have a filing obligation in California.

Although not explicit, the TAM may be applied retroactively. As such, the application of this new guidance could, depending on a business’s fact pattern, either reduce its California tax expense or result in an unreported tax liability.

The application of PL 86-272 to a specific set of facts is a complex undertaking and is subject to uncertainty. The TAM outlines California’s interpretation of a federal law, and it may or may not align with the intent of the US Congress. Its interpretation of a federal statute is unlikely to be given the same weight as an interpretation of the state’s own statute.

However, taxpayers that have historically claimed they don’t have an income tax filing obligation in California because of the protections provided by PL 86-272 should re-examine their activities to determine if that still applies in light of the new guidance.

In 2018, the California Earned Income Tax Credit (EITC) was extended to help low-income taxpayers. In 2019, AB 91 raised the maximum eligible amount of earned income to $30,000. The bill also added a refundable young child tax credit of up to $1,000 per qualified taxpayer, per taxable year.

For tax year 2021, the FTB published a bulletin addressing recent changes to qualification criteria and outlining a process to claim it for taxpayers who became eligible for the credit.

The FTB’s webpage details credit amounts, income limits, qualifications, and additional information.

SB 113 also changed the ordering of when California income tax credits would be applied, such that the out-of-state tax credit (OSTC) would be claimed before the PTE tax credit.

However, the legislation didn’t change how the OSTC would be calculated in conjunction with the PTE tax. On September 28th, 2022, Governor Gavin Newsom signed SB 851, a bill to fix a tax credit calculation limitation that arose with the California elective PTE tax.

The OSTC is calculated as the lesser of either:

California tax liability, prior to the enactment of SB 851, meant the taxpayer’s California tax liability without reduction for the OSTC, but after reduction of all other credits, including the PTE tax credit. This meant that prior to the enactment of SB 851, many California taxpayers that opted into the PTE tax, and had income tax liabilities in other states, would receive no OSTC because the PTE tax credit absorbed their entire California tax liability.

For tax years beginning on or after January 1, 2022, and prior to 2026, SB 851 fixes the above issue. Under the legislation, for purposes of computing the OSTC, the taxpayer’s amount of net California tax subject to the OSTC will be increased by the amount of PTE tax credit claimed during the taxable year.

As a result, the chances of double taxation on the same income should be reduced for California resident taxpayers and residents of reverse credit states such as Arizona and Oregon. Notably, this legislation doesn’t apply for tax years beginning in 2021, the first year the California PTE tax election was in effect.

Effective January 1, 2022, the FTB pays 0% interest on corporate overpayments. This rate is effective through December 31, 2022.

The interest rate for personal income tax underpayments and overpayments, corporation underpayments, and estimate penalties is 3%. This rate is effective through December 31, 2022.

For interest rates after December 31, 2022, the FTB will provide more information on its website as it becomes available. Historic interest rates can also be found on the same site.

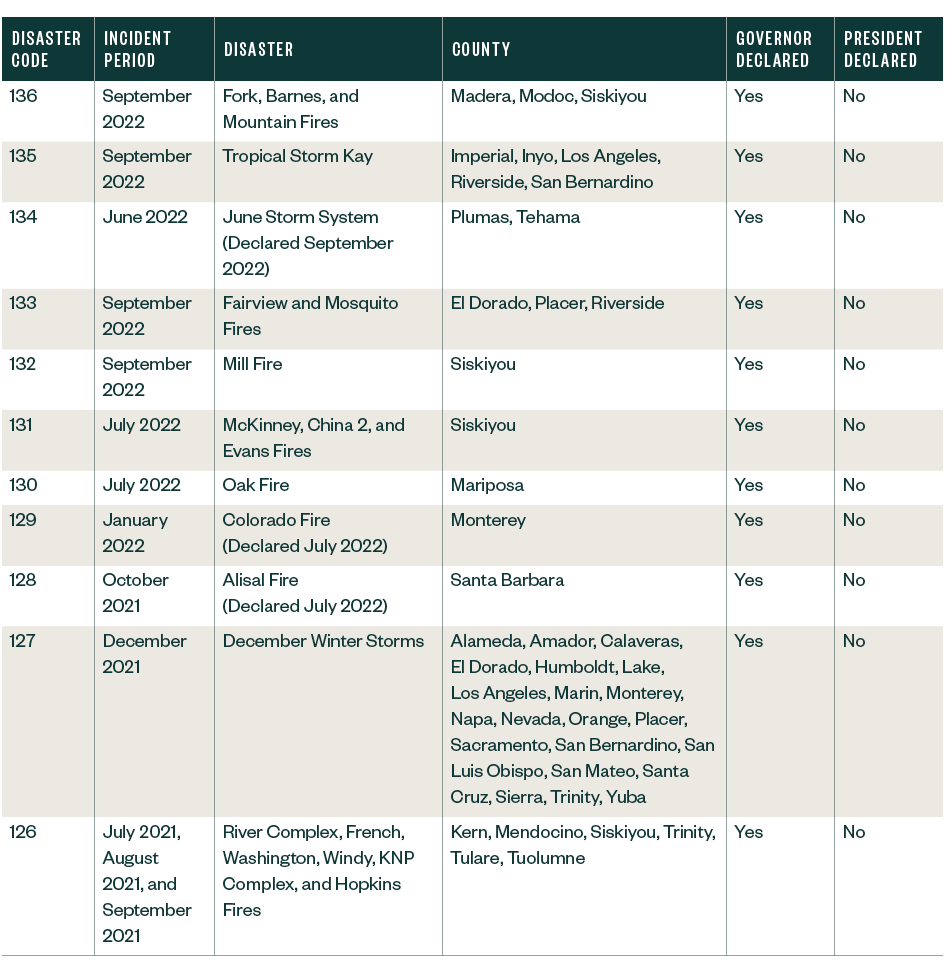

California taxpayers may deduct losses in any president- or governor-declared disaster area.

In this regard, the state generally follows federal law regarding the treatment of losses incurred as a result of a casualty or disaster, though relevant nonconforming provisions still apply.

The FTB automatically follows the IRS’s extended deadlines to file or pay taxes until the date indicated for the specific disaster.

Taxpayers should write the disaster name in dark ink at the top of their tax return to alert the FTB of the disaster to which the return is related.

The IRS disaster relief webpage lists additional designated areas eligible for a postponement period.

If a taxpayer qualifies for the postponement period, any interest, late-filing, or late-payment penalties that would otherwise apply will be cancelled. The FTB also will follow these stipulations.

Taxpayers may deduct a disaster loss sustained in a California city or county where the governor declares a state of emergency.

The list of California Qualified Disasters is below as published on the FTB website on September 30, 2022.

Visit the FTB website and Publication 1034, Disaster Loss How to Claim a State Deduction, for more information regarding California disaster losses.

Tax professionals may have noticed a new set of questions on their business entity clients’ income tax returns. Specifically, California is now inquiring as to whether corporate and pass-through entities have filed unclaimed property reports with the state and, if so, when the last reported was filed.

Financial assets left inactive by a legal owner beyond a set deadline—which varies depending on the property type—are transferable to the state. This can include uncashed checks, refunds, annuities, or security deposits.

For some taxpayers, these assets can accumulate and remain on financial records for several years even after they should have been reported, and paid over, to the state to administer on behalf of the public using a unified search tool. A historically under-reported area of tax law across all states, unclaimed property is now in California’s sights as an area to promote increased compliance.

In connection with this change, California has established a program to encourage compliance by otherwise-delinquent taxpayers by offering an opportunity to mitigate the potential impact associated with failing to report unclaimed property from prior periods.

Governor Gavin Newsom signed AB 2280 into law on September 13, 2022. AB 2280 authorizes the controller to:

This new law authorizes the limitation of interest payable by a holder to $10,000 if a holder files an unclaimed property report that’s not in substantial compliance with statutory requirements both:

It also authorizes the controller to waive the interest payable if the holder’s failure with the report is due to a reasonable cause.

The controller can also waive the interest payable if an eligible holder participates and completes all the requirements of the VCP.

A holder that hasn’t reported unclaimed property can request to enroll in the program using a form prescribed by the controller.

The controller, at their discretion, can enroll eligible holders in the program.

Some holders are ineligible for enrollment in the VCP. A holder is ineligible for enrollment if, at the time the holder’s request to enroll is received by the controller, the holder is the subject of:

Additionally, holders are ineligible if the controller:

The Unclaimed Property Division won’t require the disclosure of records and information provided to the controller’s office related to statements of personal worth or financial data, or related to personal information, as defined by Section 1798.3 of the Civil Code.

Federal tax changes and related conformity requirements continue to impact California taxpayers in addition to the changing landscape of business and everyday life. As the state continues to expand, evolve, and respond to these challenges, please contact your business advisor with any questions.

For more information on the 2022 tax season and impacts on Californians, reach out to your Moss Adams professional.